Renters Insurance in and around Sullivan

Sullivan renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

No matter what you're considering as you rent a home - price, outdoor living space, number of bathrooms, apartment or house - getting the right insurance can be crucial in the event of the unexpected.

Sullivan renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

The unanticipated happens. Unfortunately, the valuables in your rented apartment, such as a video game system, a microwave and a TV, aren't immune to break-in or smoke damage. Your good neighbor, agent Michelle Beckett, is committed to helping you understand your coverage options and find the right insurance options to protect your belongings from the unexpected.

It's never a bad idea to make sure you're prepared. Contact State Farm agent Michelle Beckett for help learning more about savings options for your rented home.

Have More Questions About Renters Insurance?

Call Michelle at (573) 860-3276 or visit our FAQ page.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

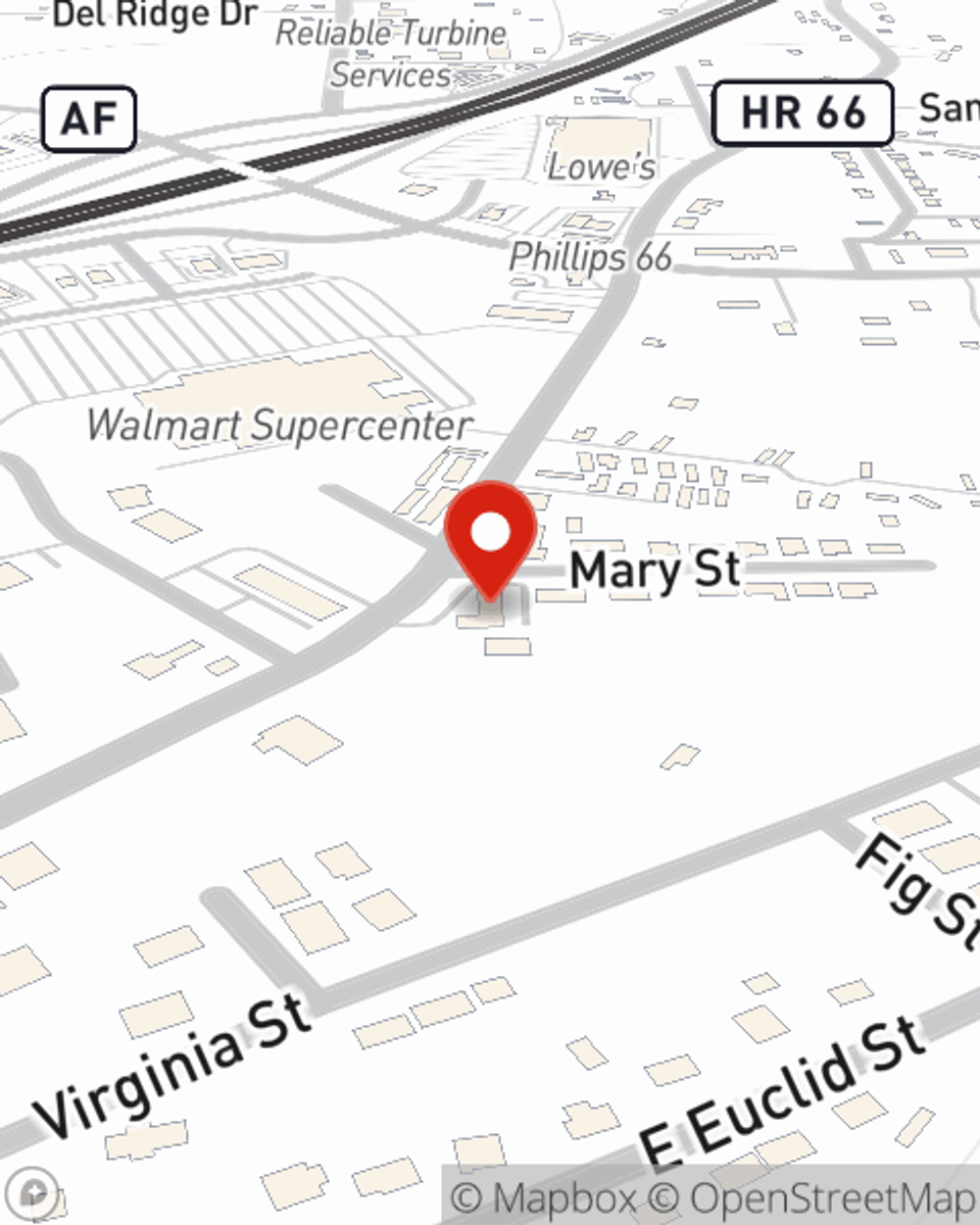

Michelle Beckett

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.